"My Two Cents"- INVESTOR BEHAVIOR by Nick Silva

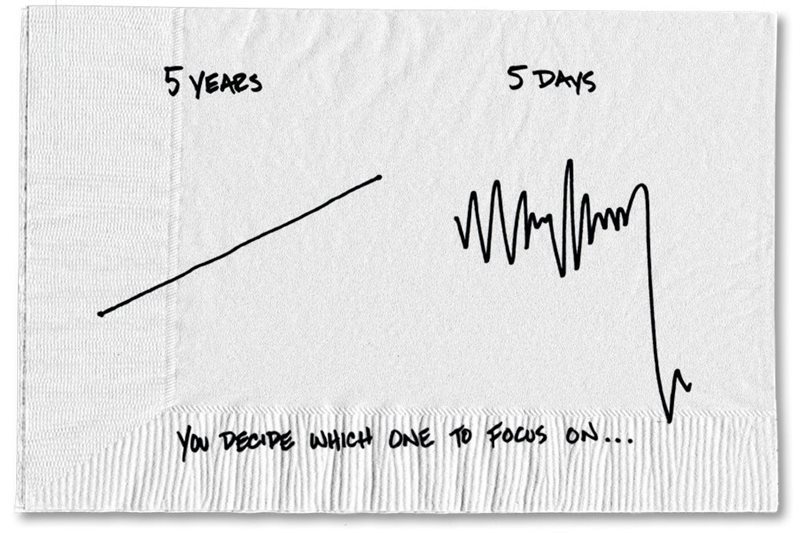

Did you see what the market did today? This week? This month? Boy, if I had a nickel for every time I heard this. My natural response is “Who cares?” Most of the clients, prospects, family and friends I speak with are not day traders. They are investing the majority of their money for a long term goal such as retirement or a child’s education. Generally, these long term goals align with a 10 to 30 year time horizon. So why are most people so concerned with a short term market move, such as 1 day or even 1 month? Most likely because a co-worker, a brother in law, or CNBC pointed it out with emphasis, to portray some sort of significance and applicability to them. To put things in perspective, consider this: 10 years = 3,650 days and 30 years= 10,950 days. So how much weight does a 1 day, 1 week, or even 1 month market move have on your long term return? See my point? The urges we feel to make money moves based on the abundance of new information can be credited to our innate behavioral instincts. In the next post, we will dive into more detail on instinctual behavior, how it often leads to bad money moves, and how to help control it. (1)Asset allocation and diversification do not guarantee a profit or protect against investment loss, but are intended to help manage your goals and risk tolerance. They are methods used to help manage investment risk. The information provided is general and intended to inform and educate. It is not intended as an offering of any specific products or services, nor to be construed as specific investment, legal or tax advice. Individual situations can vary, as such; this information should only be relied upon along with an individual assessment in light of your own specific situation.

Just in case you are a more visual learner, I love this simple sketch included up on the right by Carl Richards from his well known book “The Behavior Gap” *Hypothetical example is for illustrative purposes only.

The main point here is to keep in line with your long term plan, and learn to ignore all of the hoopla and noise, as almost all of it will have no measurable effect on your plan. It can be difficult for us to think long term, but we must trust the process: save the right amount, diversify(1), and periodically rebalance. It may be mundane, but I believe that it will give you the best probability of long term success.